India and China are facing an unprecedented enmity at this point in time, especially past the Galwan valley incident. China, which is known for unleashing a full-fledged covert, financial and military war against its adversaries, has launched an assault against India, and the shocking part is that most of the Indians are still unaware of China’s evil intentions.

China is known for shelling out huge money as a ‘Loan’ to several developing nations, and then it put pressure on those nations and captures their strategic and valuable assets. We have seen several examples especially in Sri Lanka and several African countries, where China has occupied their important assets once these countries were unable to return loans. That’s how China unleashes its financial assault to destabilize the economies of other nations.

China can’t entrap India in such tactics, as India never takes any financial aid from China, hence it has unleashed a unique financial attack to destabilize the Indian economy.

Technology has been a big enabler but it could be a curse as well, and China has orchestrated a Technology-abled conspiracy to attack the Indian economy. Chinese operators have targeted the lower-income residents of India, offered them loans via mobile applications, hired Indian underlings to torcher the innocents, and snatch away their money and peace of mind.

You will be shocked to know that since last year, more than $3 billion worth of scams have been committed by these Chinese microloan applications, and the bulk of this amount has been siphoned off.

Scam of Billions – China captured an unprecedented opportunity

With the advent of the Internet, we have witnessed giant strides in areas such as e-commerce, transportation, retail, telecom, food-tech, logistics, and cloud services. Technological advancement led to the app revolution, which has started to empower consumers and enterprises alike.

At the same time, there was another area that was witnessing innovative solutions and workflows enhancements, and that area was the Fintech market. This ara is known for providing solutions in the form of digital payment, wealth management, consumer credit, supply chain finance, and insurance.

We had another problem at hand, our tier-2, tier-3 cities, and smaller towns have always been starved of banking avenues and services. Private sector banks are not finding these rural areas profitable, hence they were not expanding their operations in the hinterland.

Our digital payments revolution did try to alleviate this issue to help the unbanked people, but the lack of adequate infrastructure has made it cumbersome to implement financial inclusion in true spirit. China was keenly observing this situation and they grabbed this newfound opportunity and bombarded the Indian market with numerous Fintech solution organizations.

They launched many loan applications with unprecedented offers and lure the marginalized Indians to avail of easy and instant-loan approvals from an array of these fintech applications. China has specifically chosen the COVID time when pandemic-induced joblessness and pay cuts have led to an urgent need for cash, the dire situation of these people is exacerbated in 2020, making them ripe for exploitation.

The ‘Evil’ Modus Operandi

These applications spend a huge amount on promotion, and one can see their advertisements on social media. People usually get messages, where they ask to download an application to get a guaranteed loan, that too with comparatively fewer approval hassles.

Now, this is how this scam unfolds. Suppose a lady installs an application and applies for a loan, say for INR 10,000. In few days she will observe that money deposited in her account from 5-6 different applications, that she never have downloaded onto her phone. The customer got no idea from where this amount is being deposited in her account, and before she is able to make sense of what is going on, she will be getting threatening calls from rude collection agents from all of these apps for the repayment of the amount, which is now 5-6 times of the amount she has borrowed at the first place.

You may wonder what’s the scam in this? Well, here is a catch.

When this already severely cash-strapped lady is unable to repay her loans, the collection agents morph her face onto naked bodies to create pornographic images of her. These images are forwarded to her contacts, WhatsApp groups. The fintech application already has the access to the Contacts and Gallery as a part of the agreement customer accepted while installing the application. The personal data of the customer is essentially used as collateral.

This kind of public humiliation and shame has resulted in six suicides in the state of Telangana only, this figure is too high if we consider the entire nation. The collection agents charge hefty interest and other changes from the people who are ready to repay their loans.

Data – the ‘Real’ money exploited by Chinese Apps

There are thousands of FIRs filed against these apps, and when Indian law enforcement agencies started the investigations, they were shocked beyond their belief.

Most of the applications were violating the Indian banking rules on lending. They were storing the data on Chinese servers. There are hundreds of fintech applications are available in the market, such as Happy Cash, Loan Gram, Mint Cash, Cash Train, AAA Cash, Cash Bus, Super Cash, Repay One, Loan Card, Monkey box, Cash Goo, Rupee Day, among many.

These applications don’t take the usual documents, they offer microloans with a shorter repayment period, and astonishingly higher interest rates, mostly 1% a day, which compounds every two weeks. Such an interest is too difficult to pay for a modestly earning person, let alone the person impacted by the pandemic-induced cash flow crisis.

Indian agencies found that hundreds of these applications are operated from abroad and even the usernames and passwords were in Mandarin. Chinese nationals were using Indian proxies as Directors and engaging the local CAs to establish their Indian branch.

National Security Issue and Collapse of Indian Fintech Industry

You will be shocked to know that sensitive information details of Indian citizens, who have committed more than 14 million transactions using these apps, have already transferred their Aadhaar, PAN, and other identity proofs to Chinese servers. The demographic and other important information like Indian citizens’ facial images, fingerprints are now sat comfortably on Chinese servers and this has created a massive national security issue.

These applications have led to an untimely collapse of the Indian Fintech sector because borrowers were pushed to take multiple loans which became simply unpayable. Many people have already committed suicide, many have associated themselves with this industry forever, which is marking an unceremonious collapse of this industry.

What Indian Government is doing?

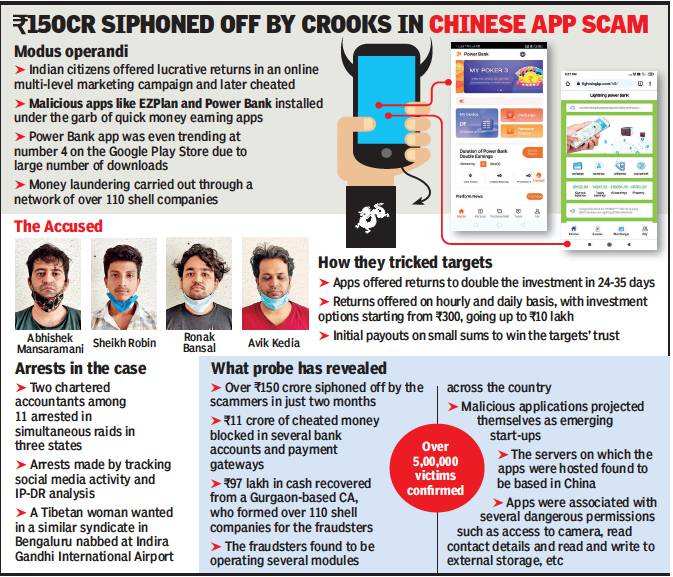

It seems that history is destined to repeat itself if checks and balances are not urgently established. Fortunately, the Indian law enforcement agencies have started taking action against these Chinese applications. Police from four different states have arrested many Chinese nationals, ED has also taken action against several Chinese companies, which were involved in this scam.

Several CAs have been arrested, who helped these companies to create hundreds of shell companies, which were used to siphon out billions of rupees outside India.

Last year, the Modi government had to put a ban on 224 Chinese apps, which were found involved in fraudulent activity such as breaching the privacy of the consumer and digital espionage. However, we can still found many Fintech applications, that are not directly Chinese but getting funds from Chinese corporations. The Indian Government must conduct a thorough investigation and put an end to this digital assault on the Indian economy.